Biography

Haris Karagiannakis is an Analyst in the Forecasting and Policy Modelling Division at the European Central Bank. He holds a PhD in Econometrics from King’s College London, where his research focused on utilizing existing Machine Learning techniques and developing novel methodologies to improve real-time monitoring of economic activity . His doctoral studies were fully funded by the Qatar Centre for Global Banking & Finance (QCGBF) at KCL.

Haris studied both economics and finance at postgraduate level. He holds an MSc in Economics from the London School of Economics and Political Science, and an MSc in Financial Economics from the University of Cyprus, and he received merit-based scholarships to fund both his undergraduate and postgraduate studies. He has earned several awards and distinctions in regional and international competitions for his undergraduate and postgraduate theses. Before joining KCL, Haris worked as a research officer (2010–2019), involved in applied cutting-edge quantitative research on account of organizations and companies. His research interests include real-time macroeconomic forecasting and factor investment strategies. While at King’s, he also taught MSc courses, including Introduction to Big Data Analytics and Statistical Software for Finance .

Download my job market paper

Download my resumé

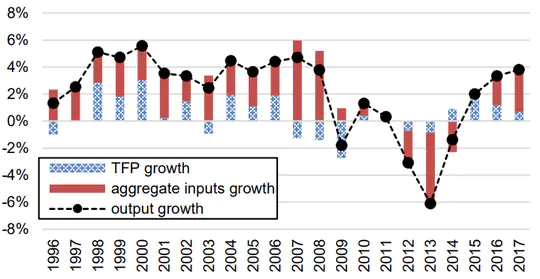

- Macroeconomic forecasting and nowcasting

- Predictive time series modelling

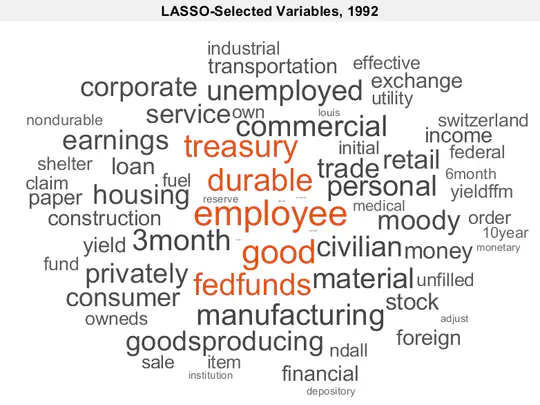

- Machine Learning

- Macroeconometrics

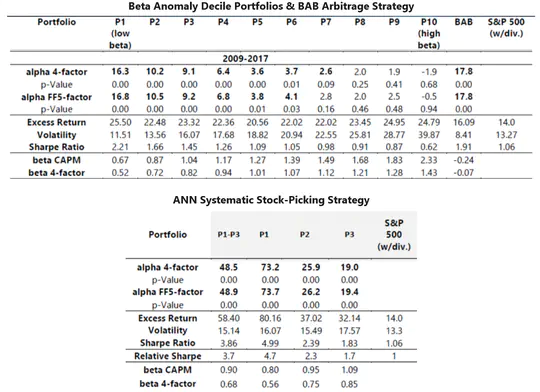

- Trade-signal generation

PhD in Econometrics, 2025

King's College London

MSc in Financial Economics

University of Cyprus

MSc in Economics

London School of Economics

Teaching

2022-2023

- Introduction to Big Data Analytics at KCL

MSc module - tutorial [ Notes ]

2021-2024

- Stats Software for Finance at KCL

MSc module - Pre-dissertation course on financial econometrics, and asset pricing using Stata [ Slides ]

US Inflation Forecasts from KCL MSc Students

In this section I will frequently be updating the nowcasts obtained using the forecasting model we developed in class at the Intro to BDA course, to see how it performs. The updated inflation nowcasts for each month will be released every 2nd and 4th week of the month, and are labeled below as preliminary and advance nowcasts, respectively.

Disclaimer: The forecasts in this section are based on state-of-the-art techniques but with many simplifications along the way, to make the material accessible and easily understandable by students. Therefore, they are provided only for educational purposes. Specifically, the model is an exact replication of the last week’s material as shown in the course notes above. To see how forecasting methods taught at the MSc level, compare to PhD level forecasts and state-of-the-art latest published research, see here.